Budget 2022: A Lot of Tax, A Lot of Spend

Ending domestic travel mandates, firefighters on Parliament Hill, NATO at 2%, and more

Budget 2022: The Details

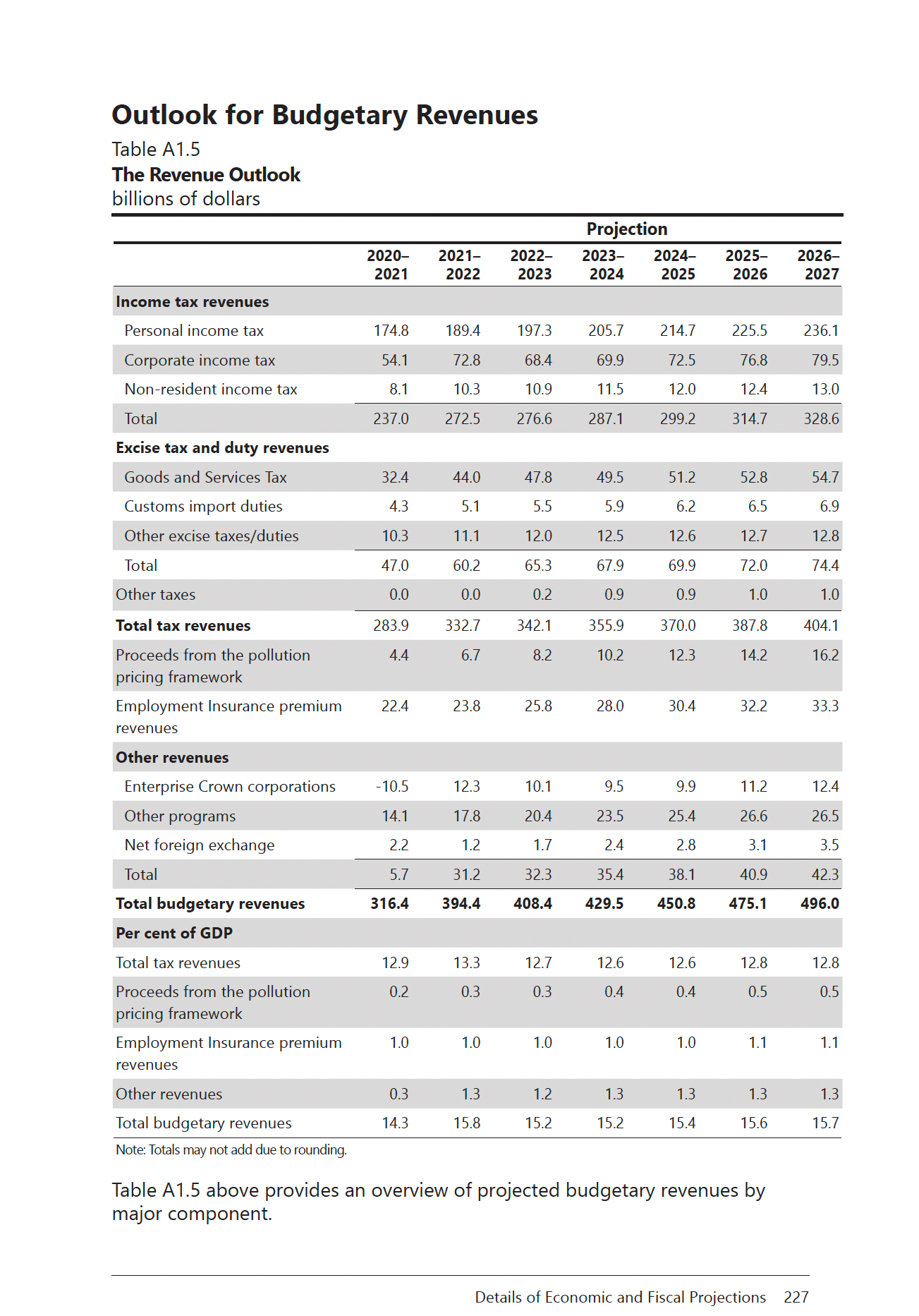

We all owe another $1,400 as of yesterday. That’s how much the $52.8 billion broken down per person costs every single one of us. The budget clocks in at just under 300 pages and the supplementary information on tax measures at just over 100 pages. My quick reading won’t cover every point or capture the nuance of every measure which just one day of review but I wanted to provide this initial assessment.

This is a tax and spend NDP budget. The first Canada has ever seen. There is more than $60 billion of new spending since the Fall Economic Statement. Every dollar of new revenues generated by record GST and personal income tax revenues is being spent – that’s $39.3 billion in unexpected revenue. The former deputy Parliamentary Budget Officer said the federal government has been doing this for years; every time they get new additional revenues, they spend it. This is not responsible public budgeting. Canadians needed a break and they did not get it. Taxes are going up and new costs being shouldered on to businesses will eventually be passed on to consumers. It is an easy accusation to level but the Trudeau government is essentially buying the votes of the NDP parliamentary caucus with new and unplanned spending. This is reckless spending and un-targeted spending.

Looking closer to different initiatives I wanted to briefly cover a few that might be missed in the news. The NDP-Liberals are getting defence spending up to 1.5% in this budget and will not be able to get to the NATO 2% target allies have agreed to since the Wales meeting in 2014. This is despite the Russian war of aggression against Ukraine. This spending includes the purchase of the F-35 fighter jets that the last conservative government has approved and the Liberals eventually re-confirmed in the past couple of weeks. The dentalcare plan in the budget runs at an estimated $5.3 billion. There is no explanation of how this intrusion into a provincial jurisdiction will be handled. There is no explanation of how private insurance plans will be interacted with or who in the federal bureaucracy will be tasked with running this new program. I can only pray it will not be those responsible for defence procurement, or the CRA customer service desks or the IT development of the continually failing Phoenix pay system. There is no spending or new information on a national pharmacare program which would add over $11 billion per year in spending in the future. There is a ban on foreign homebuyers for two years, however the exemption list is so broad that it essentially can be circumvented easily. The Carbon capture and sequestration tax incentives will specifically exclude enhanced oil recovery which will exclude many worthy Western Canada projects and lead to more job losses to the United States of America where their carbon sequestration tax system allows for it. Small and medium oil and gas businesses will see flow-through shared be eliminated which is terrible news for the scrappiest and most innovative part of the energy sector. The federal government is promising legislation to provide three days of paid leave for employees in federally regulated workplaces who experience a miscarriage or stillbirth – a measure I heartily support – after I was successful in adding eight weeks of unpaid leave for employees who lose a child in December 2021. The NDP-Liberals are also extending the failing First-Time Home Buyer Incentive or FTHBI program that was supposed to end in September 2022 to March 31, 2025. The FTHBI has only reached about 13,000 of its 100,000 target and is proving to be a dud the federal government could have avoided. In fact, none of the new programs will add a single home on to the market. Oddly, the new Tax-Free First Home Savings Account or TFHSA will only allow up to $8,000 per year in contributions so it won’t provide any help immediately for aspiring homeowners looking to save for a down payment. Even odder is that the RRSP home buyers’ plan or HBP will not be eligible to be combined with the TFHSA. You read that right. You can either make use of your existing HBP or the TFHSA, but not both. There is no explanation why.

I will end with a little more numbers again. The federal government expects to rack up a total of $1.3 trillion in total national debt by the end of fiscal year 2026-2027. This is double what they inherited from the Harper conservative government. Public debt interest payments will go from $26.9 billion to $42.9 billion in 5 years. We will pay more to service the debt than we do for the Canada Child Benefit annually or Equalization. The most expensive government programs will be for seniors or elderly as described in Table A1.6 with $87.2 billion spent in five short years. Going back to budget 2017 that the Trudeau government produced 5 years ago, they expected to be spending on programs $356 billion in 2021-2022 and instead they revealed they had reached $394.4 billion. Now that the pandemic fiscal impact is being wound down you would imagine those numbers to go down but instead the federal government is expecting spending to reach $496 billion by 2026. A half a trillion dollar spending federal government. It should leave all taxpaying citizens wondering are they getting value for money?

Federal Vaccine Mandates

On April 5th, I stood in Parliament and called again to end the federal vaccine mandates. These unscientific restrictions have done more harm than good. I’ve received countless emails from you and I’ll continue to press the government on it.

Firefighters Visit Parliament Hill

This week, I met with firefighters from Calgary and Strathcona who were advocating for better household and building code standards. With changes in material goods, fires today are significantly more toxic than they were 20 years ago. The health risks in this profession are higher than most. Take some time this week to thank a firefighter for the work they do for Calgary and beyond.

Parliament calls on federal government to commit 2% of GDP on defence

This week in Parliament, Conservatives called on the government to increase spending on national defence to at least two percent of Canada's GDP, in accordance with NATO's 2014 Wales Summit Declaration. This motion was put to vote and passed, despite opposition from the NDPs and Greens. However, the NDP-Liberal government walked back on that promise after just one day. On Thursday the NDP-Liberal government released their federal budget for 2022 that accounts for an increase in defence spending from 1.36 percent to around 1.5 percent of Canada’s GDP, far short of the 2% it had promised just one day earlier. With no clear plan on how all this money will be allocated, Canadians cannot be confident in their ability to follow through on any of its commitments. How can Canadians be confident in the Prime Minister when his government hangs in the balance of a coalition partner whose activist base regularly debates policies like ‘phasing out the Canadian Armed Forces,’ and ‘removing the NATO nuclear ring around Russian borders? Conservatives will continue to ensure that Canada remains a trusted NATO ally; and that we make the necessary investments to keep Canadians safe and secure in a world that is getting increasingly less safe. I alongside my Conservative colleagues will continue to hold the government accountable for their promise to increase defence spending..

‘Resuming Debate’ - Back In Two Weeks

‘Resuming Debate’ will be on hiatus for two weeks over the Easter and Passover holidays. Thank you for subscribing to this Substack newsletter. I appreciate your comments, in agreement or disagreement with me. As an elected official, it’s important for me to receive constant feedback. This has been a great avenue to do it. Share this Substack with your friends and family, so the debate can grow. Have a great Easter and I will be back for a new edition on April 29th.